Business Incorporation

A Private Limited Company is the most popular business structure in India for startups and growing businesses. It offers limited liability, separate legal entity status, and ease of raising funding from investors. Ideal for entrepreneurs aiming for scale, branding, and structured operations. Compliant with the Companies Act, 2013.

An LLP blends the operational flexibility of a partnership with the legal benefits of a corporation. Each partner’s liability is limited to their contribution. This is a great option for consulting firms, small businesses, or service-based ventures that don’t want rigid corporate formalities.

An OPC allows a single individual to operate a corporate entity with limited liability. It's ideal for solo entrepreneurs who want full control over their business while enjoying legal protection. Requires only one director and shareholder.

A traditional business structure governed by the Indian Partnership Act, 1932. It's best suited for small businesses or family-run operations. StartupFino helps with drafting partnership deeds and registering with the local registrar.

Section 8 Companies are ideal for non-profits, NGOs, and charitable organizations looking to operate formally. They enjoy tax exemptions and credibility, and must reinvest profits toward their objectives (not for personal gain).

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

For charitable or religious purposes, trust registration provides legal standing under the Indian Trusts Act. Trusts can own assets, accept donations, and benefit from tax exemptions under 80G/12A.

Used by cultural, educational, or social organizations for community benefit. Societies must be registered under the Societies Registration Act, 1860 and require at least seven members.

A type of Non-Banking Financial Company (NBFC) that accepts deposits and provides loans to its members. It promotes savings among its members and is governed by Section 406 of the Companies Act, 2013.

The simplest business form for solo entrepreneurs. Requires minimal documentation and is best for low-risk businesses. Although it doesn’t offer limited liability, it's fast and easy to start.

For foreign companies looking to establish a base in India, this structure allows 100% FDI under automatic route in most sectors. StartupFino assists with RBI compliance, FEMA guidelines, and ROC formalities.

Created for farmers or producers to collectively operate and benefit from agricultural production. Registered under the Companies Act and eligible for government schemes.

Convert your traditional partnership into an LLP to gain limited liability and regulatory benefits without starting from scratch. StartupFino ensures a smooth transition with ROC filings.

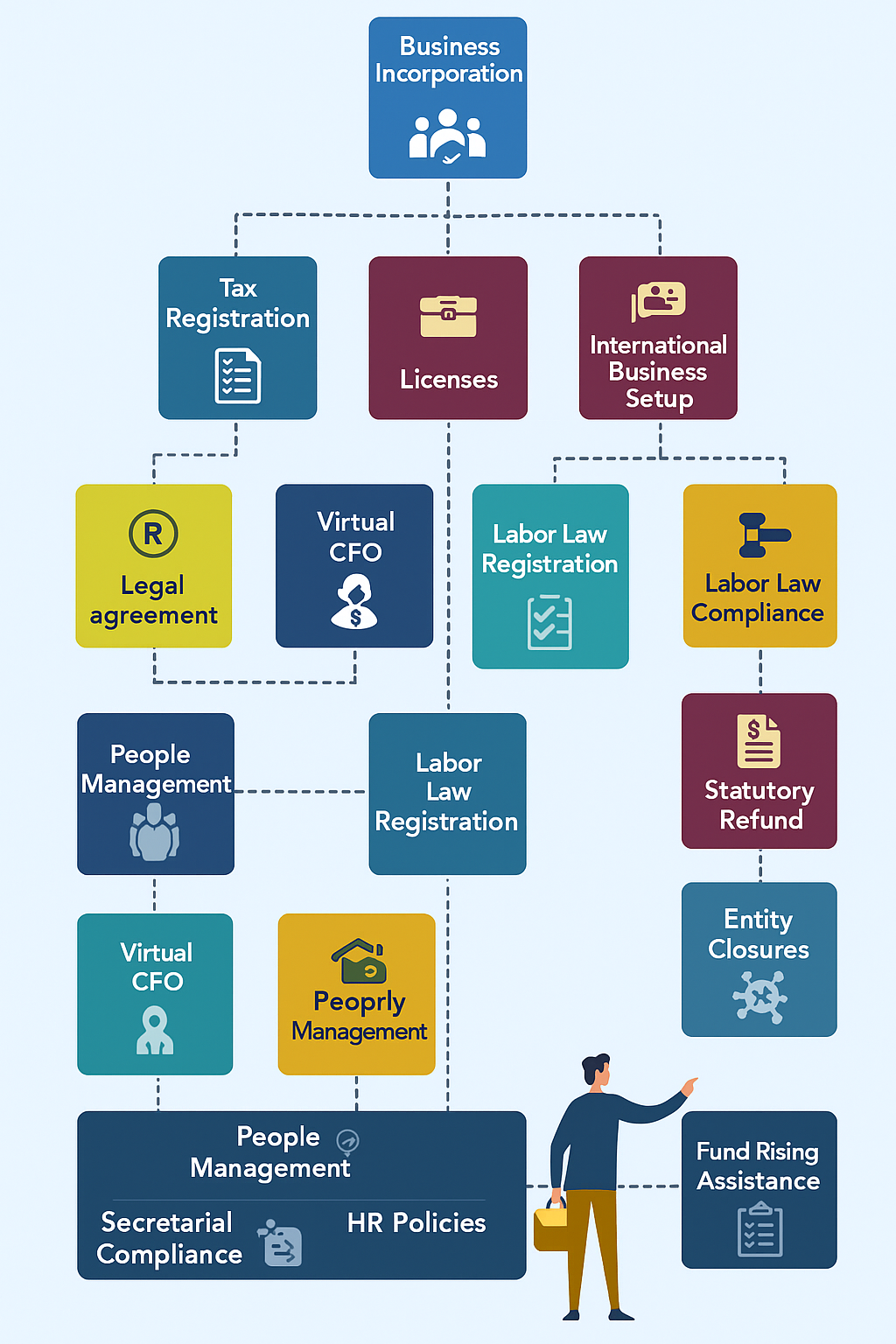

Apart from registration, StartupFino offers business consulting services to help you choose the right structure, handle legal formalities, maintain compliance, and scale with proper financial planning.